Welcome to the new normal: EPI and Wero lead the way to Instant Payments Regulation Adoption

January 30, 2025

The European Union’s new Instant Payments Regulation (IPR) marks a significant milestone in the continent’s financial industry by ensuring the secure transfer of Euro funds with instant payment capabilities. As a key player in the payments ecosystem, the European Payments Initiative (EPI) and the Wero digital wallet is at the forefront of this transformation, delivering innovative solutions that meet regulatory standards and exceed consumer expectations.

Understanding the Instant Payments Regulation (IPR)

IPR is designed to enhance the payment experience for consumers across the continent. The regulation mandates (SCT Inst) instant payments, ensuring real-time transactions (within 10 seconds) for unparalleled speed and convenience.

From January 2025, PSPs in the Eurozone have been obliged to allow their customers to receive instant credit transfers and to offer them at a price no higher than f standard credit transfers. In October 2025 this will be extended to allow the sending of instant payments. In 2027 PSPs in non-Euro EU countries will also fall under this regulation.

Regulation to ensure secure SEPA Instant Credit Transfers

IPR emphasizes not only the speed of instant payments but also the necessity for secure transfer mechanisms that protect consumer interests. Enhanced payee verification and a new approach for sanction screening, give consumers peace of mind when making payments.

The regulation also promotes greater transparency and accountability, ensuring consumers are well informed about the status of their transactions and any associated fees.

Wero – a key opportunity to maximise the value of instant payments

Banks have traditionally offered instant credit transfers as a premium service, so now face the challenge of adapting to this new normal by differentiating their instant credit transfer offer to build customer loyalty without compromising trust.

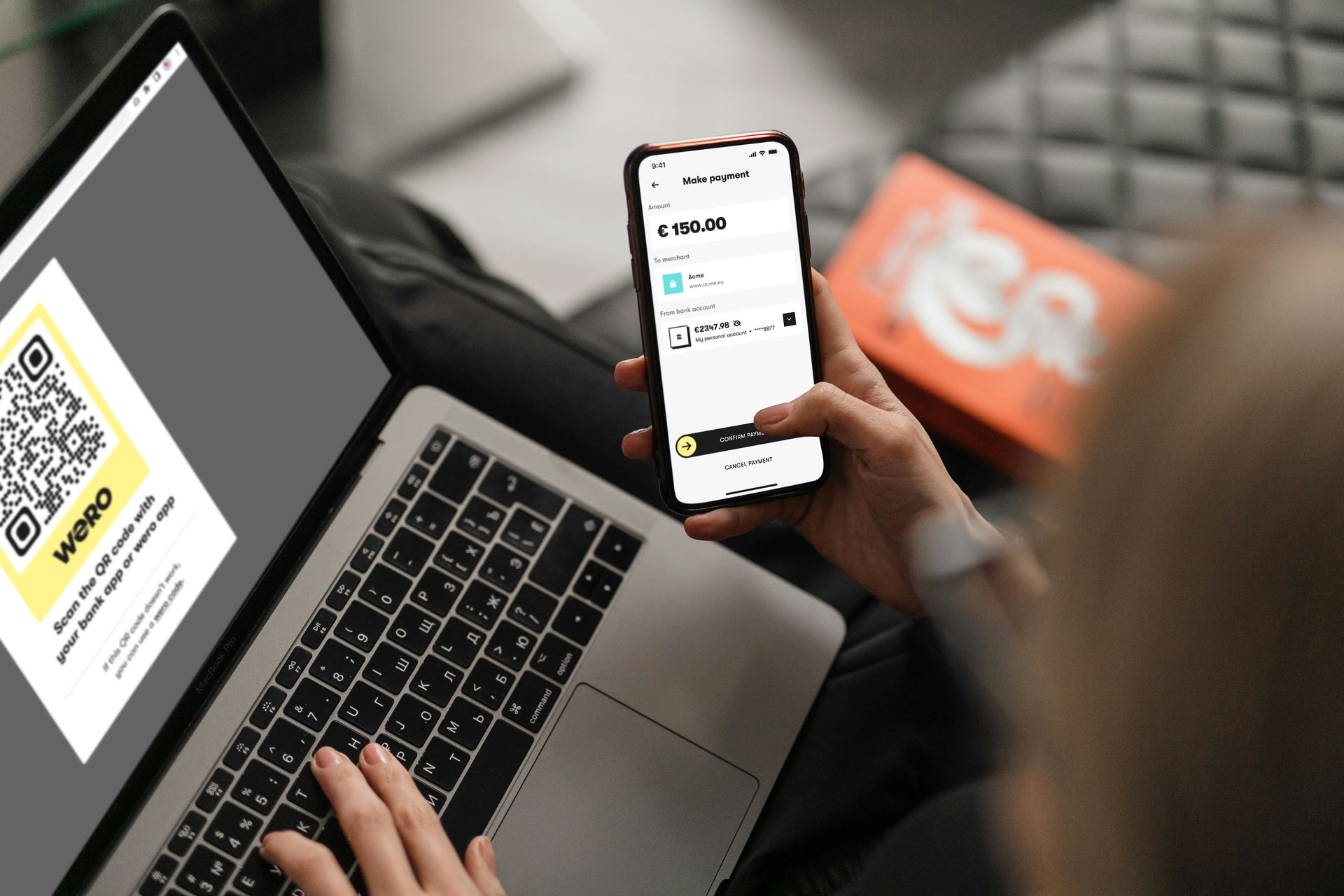

EPI's Wero digital wallet provides banks with a robust, secure, and user-friendly platform for instant payments. Fully compliant with IPR and leveraging the SCT Inst protocol, Wero enables users to send and receive money effortlessly using just a phone number or QR code. This ensures maximum convenience with a consistent user interface across all banks and countries.

Consumers maintain complete control over their payments without needing to share sensitive bank details. Available through their regular banking app or the standalone Wero app, this new and innovative solution fosters trust and encourages the adoption of instant, account-to-account payments.

Instant transfers are just the beginning

In crowded marketplace busy with noisy fintechs and tech giants, Wero is a powerful tool for existing banks to offer their customers a simple, seamless and secure way to take advantage of the convenience of direct, account-to account instant payments and build customer retention and trust.

Person to person payments is just the beginning of the Wero story. Soon customers will be able to use their digital wallets to buy goods and services online and in-store, and there are plans for complex transactions like subscriptions, consumption-based payments, buy now, pay later and more, all through one familiar, account-to-account European service with no third-party middleman, no additional accounts and no hidden fees.

The age of instant payments is here – but it is not just about speed; it also offers secure transfer methods and transparency to build consumer trust. Wero will help banks, acquirers and merchants enjoy the true benefits of IPR through its modern, user friendly unified solution for payments across Europe.