EPI and the cooperative financial network announce the first successful end-to-end Wero e-commerce transaction with a German merchant

December 16, 2024

This Proof-of-Concept transaction was completed between the end of November and mid-December using Wero e-commerce payment solution between two local banks of Volksbanken Raiffeisenbanken cooperative financial network and VR Payment on the 1.FC Kaiserslautern online shop using the Wero solution.

Brussels/Kaiserslautern, December 16th, 2024 - European Payments Initiative (EPI), the European-grown player committed to offering a sovereign and innovative payment alternative to consumers across Europe, today announced the successful completion of its first end-to-end Wero e-commerce payment transaction. The successful execution of the POC transaction on the online store of 1. FC Kaiserslautern was made possible to the involvement of EPI, Atruvia, DZ BANK, its subsidiary VR Payment along with the two pilot banks VR Bank RheinAhrEifel eG and VR Bank Südliche Weinstraße-Wasgau eG. This POC is an important milestone to the Wero roadmap and paves the way for the e-commerce use case market launch starting in summer 2025.

Between the end of November and mid-December, several transactions were successfully carried out on the online store of 1. FC Kaiserslautern as part of the POC. This first step ensures the smooth integration of Wero into the online platform of the merchant (1. FC Kaiserslautern) and its acquiring partner (VR Payments) as well as in the online banking app (VR Bank RheinAhrEifel eG and VR Bank Südliche Weinstraße-Wasgau eG) of the end-customers.

Further trials will be conducted throughout the first half of the year, before the official launch starting at the beginning in Germany over the summer. Belgium will follow in the fall and France at the beginning of 2026.

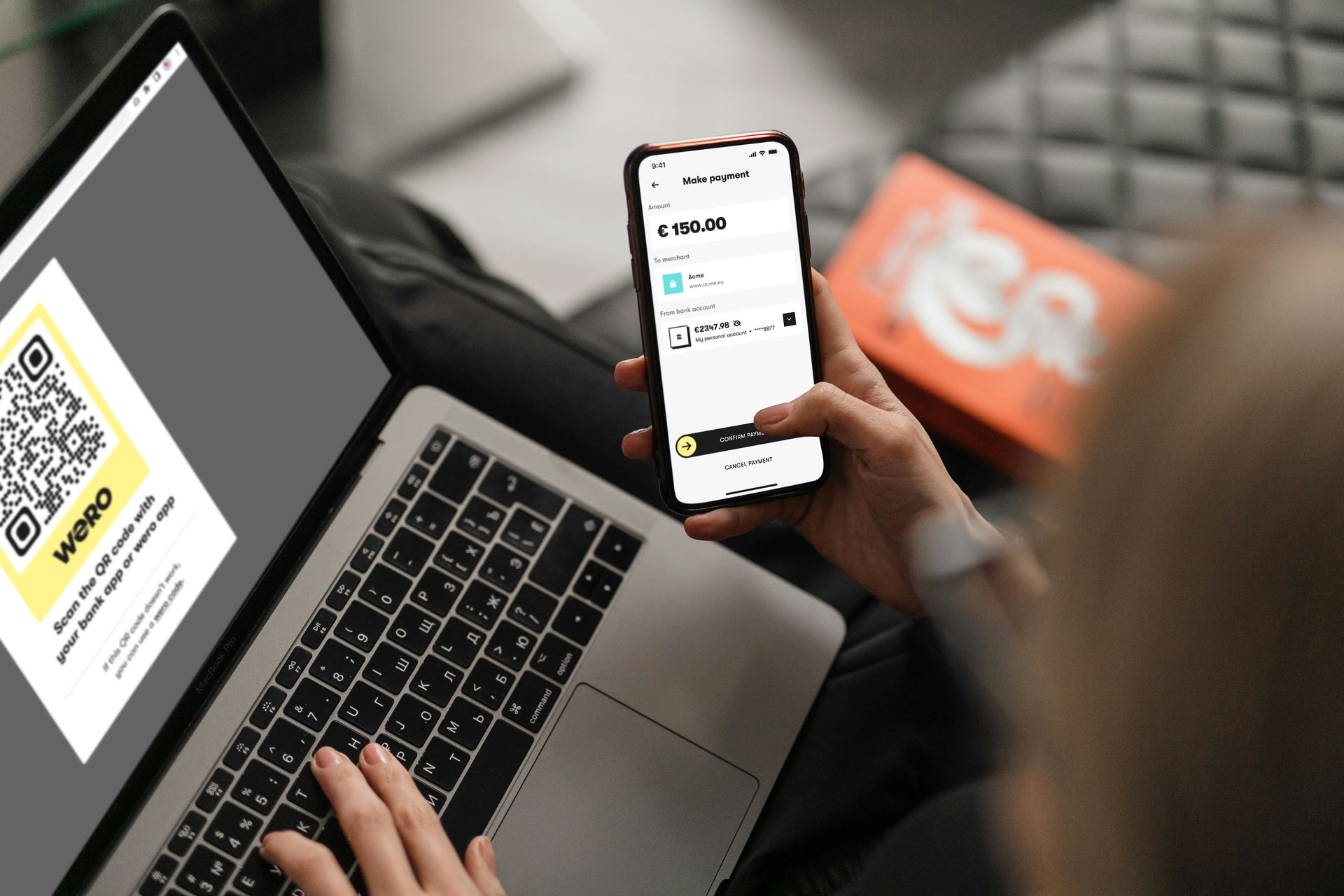

Wero will allow consumers to pay at e-commerce merchants directly with their bank account - without any intermediary or additional payment mean. The e-commerce solution will cover standard payment use cases such as one-off payments and refunds and, will add more complex payment models over time. This seamless and secure account-to-account payment method ensures the highest standards of data protection and fraud detection fully protect consumers. Merchants will enjoy a simple deployment via their usual acquirers, such as VR Payment, in this case), a seamless user experience and a competitive pricing policy compared to usual payment schemes.

“One of Wero’s key advantages is its customer-centric approach, offering enhanced usability for retail customers while ensuring easy deployment and processing for merchants. This Proof-of-Concept clearly demonstrated both benefits. As the acquirer of the Genossenschaftliche FinanzGruppe, we are proud to contribute to this significant step toward the e-commerce payment solution launch.”, explains Carlos Gómez-Sáez, Chairman of the Management Board of VR Payment.

Retailers from and operating in all three Wero pioneer countries (Germany, France and Belgium) will be able to use the solution and offer it to their consumers, following the roll-out calendar established in each country. The Netherlands and Luxembourg will follow in a subsequent step.

“Ever since the beginning of the Wero launch discussions, we were convinced we wanted to try it out. Even though we are a German football club, we have supporters in various countries across Europe and have so far been constrained in the payment options we could adopt. Wero offers us and our clients a seamless experience, while being easy to implement, and it is competitive with regards to other options on the market. It is also European, which for a European Football Club is a key asset. We are proud to have carried out the first Wero e-commerce transaction together with our house bank, VR Bank Südliche Weinstraße-Wasgau eG, and its payment transaction specialists.”, details Thomas Hengen, CEO, 1. FC Kaiserslautern.

“This POC is another key step towards our retail market entry into commercial payments, as foreseen! The aim was to prove our solution is working well end-to-end and is as simple, secure, and effective as we’ve been advocating for. I would like to heartfully thank DZ BANK's subsidiary, VR Payment, Atruvia and the Volksbanken Raiffeisenbanken involved, as well as the 1. FC Kaiserslautern teams for their involvement in this POC. Without their commitment, this success would not have been possible. Now we are entering the next phase and preparing for the broad introduction in the coming months.", says Martina Weimert, CEO, European Payments Initiative.

About EPI

EPI or European Payments Initiative is supported by 16 European banks and payment service providers. They have joined forces with a common objective: to offer a unified digital payment service for all European businesses and citizens, Wero. EPI intends to enable European consumers and merchants to make next-generation payments for all types of retail transactions via a digital wallet. Based on instant account-to-account payments, Wero will further streamline payments in Europe by eliminating intermediaries in the payment chain and the associated costs. Wero will initially support P2P payments. This will be followed by P2Pro payments and payments for online and mobile purchases. Point-of-sale payments will also be included, along with value-added services, such as merchant loyalty programs.

About VR Payment

VR Payment is one of Germany's leading payment providers and, as a company of the DZ BANK Group, the only bank-owned full-service provider. As the specialist for cashless payment of the Volksbanken Raiffeisenbanken Cooperative Financial Network, we cover the whole spectrum of payment services: from network operation, suitable terminals and card acceptance to APMs, payment solutions for apps and e-commerce, marketplace solutions and issuing services. We thus address the needs of various business models, sizes and sectors – from the bakery around the corner to the soccer stadium. From successful nationwide mobility providers to international fast-food chains.

VR Payment is responsible for approximately 286,000 terminals and 6.2 million credit cards. The company processed 845 million transactions in its network operations in 2023. Around 450 employees work at the Frankfurt am Main and Ettlingen sites.

About FC Kaiserslautern

Founded in 1900, 1. FC Kaiserslautern is a founding member of the Bundesliga and one of the largest and most successful clubs in German football. The “Red Devils” are associated with a long, rich history and many successes, most notably four German championships and two DFB Cup victories. The club is also known for its fans and atmosphere, often packing the legendary Fritz-Walter-Stadion to its capacity of nearly 50.000 people – half of the city’s population.