Belgians are using less and less cash: 35% of Belgians already pay with an app at least once a week, including 8% on a daily basis

October 21, 2024

Digital payments are becoming increasingly widespread among Belgians.

Brussels, October 17, 2024 – Digital payments are becoming increasingly widespread among Belgians. While only 12% of Belgians still use cash on a daily basis, 8% of the population already make daily payments via their mobile app, and 27% at least once a week. What's more, while Belgians prefer a secure payment app (52%), even more prefer a free app (57%). These significant results come from the European Payments Initiative (EPI) barometer, conducted by the IPSOS polling institute, analyzing consumer payment behavior in Belgium, as well as in Germany and France.

By the end of 2024, EPI will launch the digital payment application Wero whose ambition is to widely deploy its use in Europe. In order to map out Europeans' expectations in terms of payment methods, EPI carried out a survey conducted by IPSOS in three European countries. Here are the main findings:

1. Cash payments on the decline: Belgians opt for digital payments

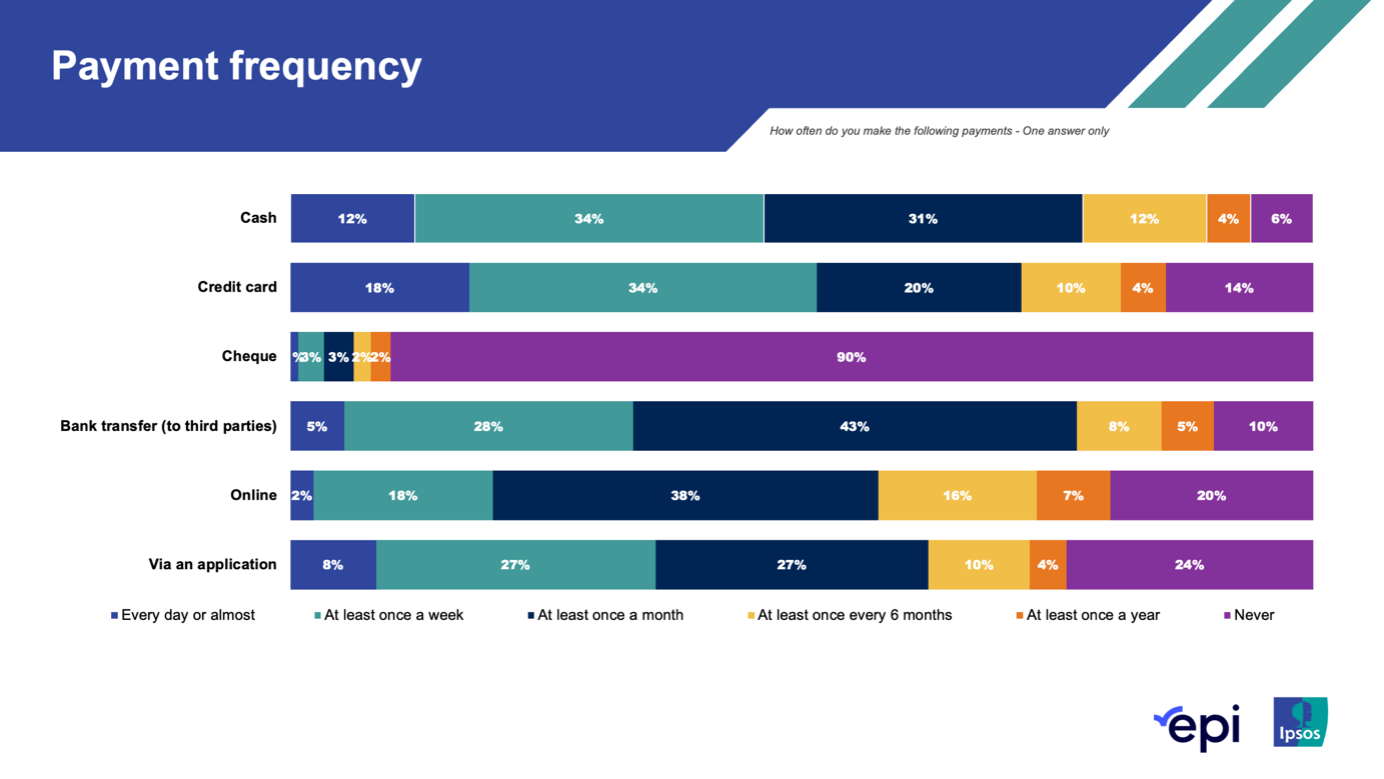

While 26% of French people still use a cheque at least once a month, payment habits in Belgium are evolving at a faster pace, characterized by a steady decline in the use of cash and an increase in the use of digital solutions. Indeed, only 12% of Belgians still use cash on a daily basis, well below the 28% recorded in Germany, for example. This reflects the strong shift towards the use of more convenient and secure payment methods. 8% of Belgians pay daily with their mobile payment app, and 27% do so at least once a week. Despite this shift, credit cards remain the preferred daily payment method for 18% of the population.

In summary, 1 in 3 Belgians use their payment app weekly or more often, although we note that 1 in 4 (24%) have never paid with it yet.

Cheques, meanwhile, are completely outdated: 90% of Belgians no longer use them.

By comparison, in France, 1 in 4 consumers use them every month!

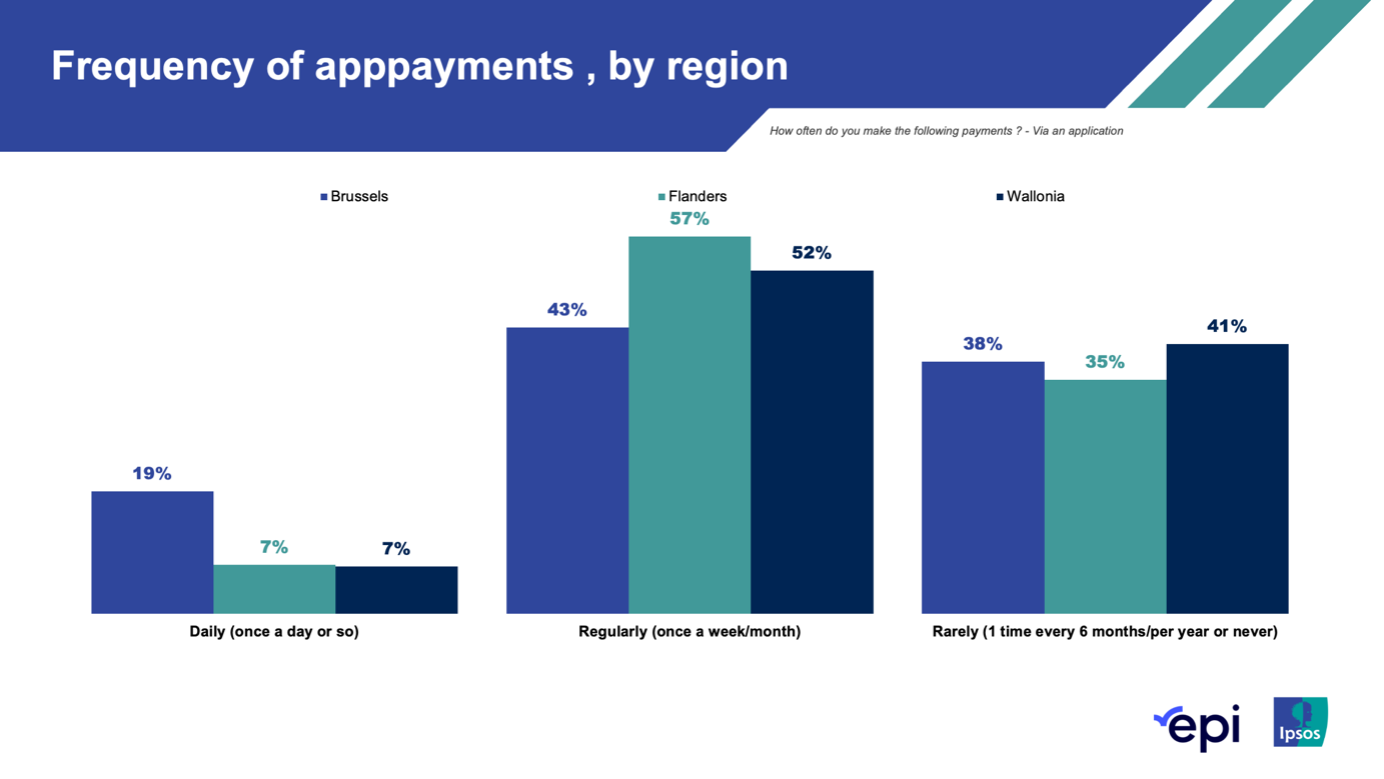

2. Brussels residents switch to digital payments faster

The use of mobile payments in Belgium shows significant differences between regions and age groups, reflecting contrasting dynamics within our country. In Brussels, 19% of residents make their daily payments via a banking app, a much higher rate than in Wallonia (7%) and Flanders (7%). It's interesting to note, however, that Flanders has the highest weekly usage rate: 31% of Flemings use their payment app at least once a week, while the figures are more modest in the other regions (23% in Wallonia and 21% in Brussels).

Ralf Hamal, Country Relationship Management Lead Belux at EPI comments: “ The results are not surprising for Brussels. It's a very international city, with 180 nationalities represented. So it's obvious that new digital payment methods are being adopted very quickly. With Wero as a European payment method, Belgians' payments will soon be even faster, easier and more secure. ”

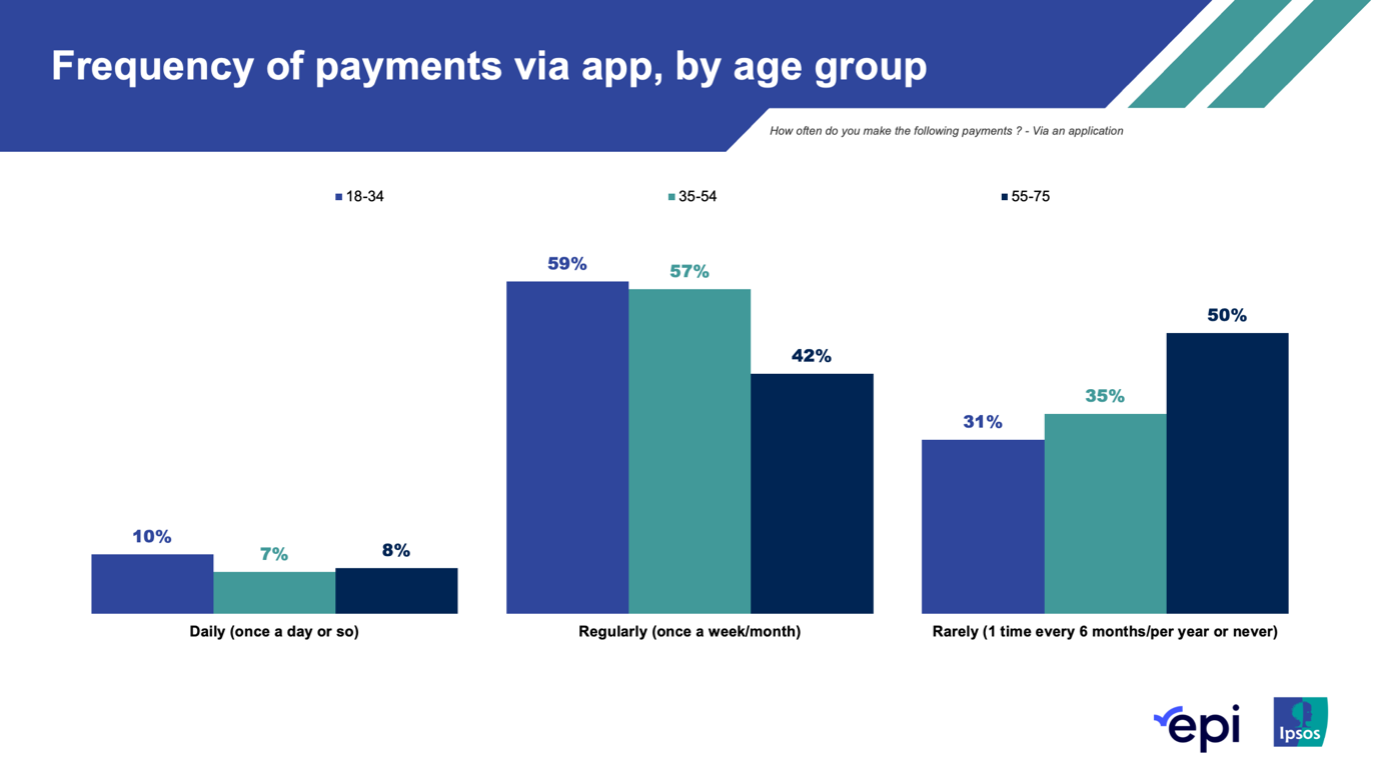

3. Young adults are changing faster than their elders

In Belgium, daily use of payments with an app is relatively evenly distributed:

10% among 18-34 year-olds, 7% among 35-54 year-olds, and 8% among 55-75 year-olds. This phenomenon illustrates the growing adoption of apps across all generations, although more marked among younger people. Also of note: 31% of 18-34 year-olds rarely or never use payment applications. This figure rises to 50% in the 55-75 age group, indicating a slowdown in the adoption of digital solutions in the older age brackets.

When it comes to Belgians' expectations of their payment methods, three main criteria stand out: free, secure and simple. Indeed, 57% of Belgians are looking for a free application, while 52% place security at the top of their list of priorities. Ease of use is also paramount for 57% of users, which explains the growing popularity of mobile payment applications.

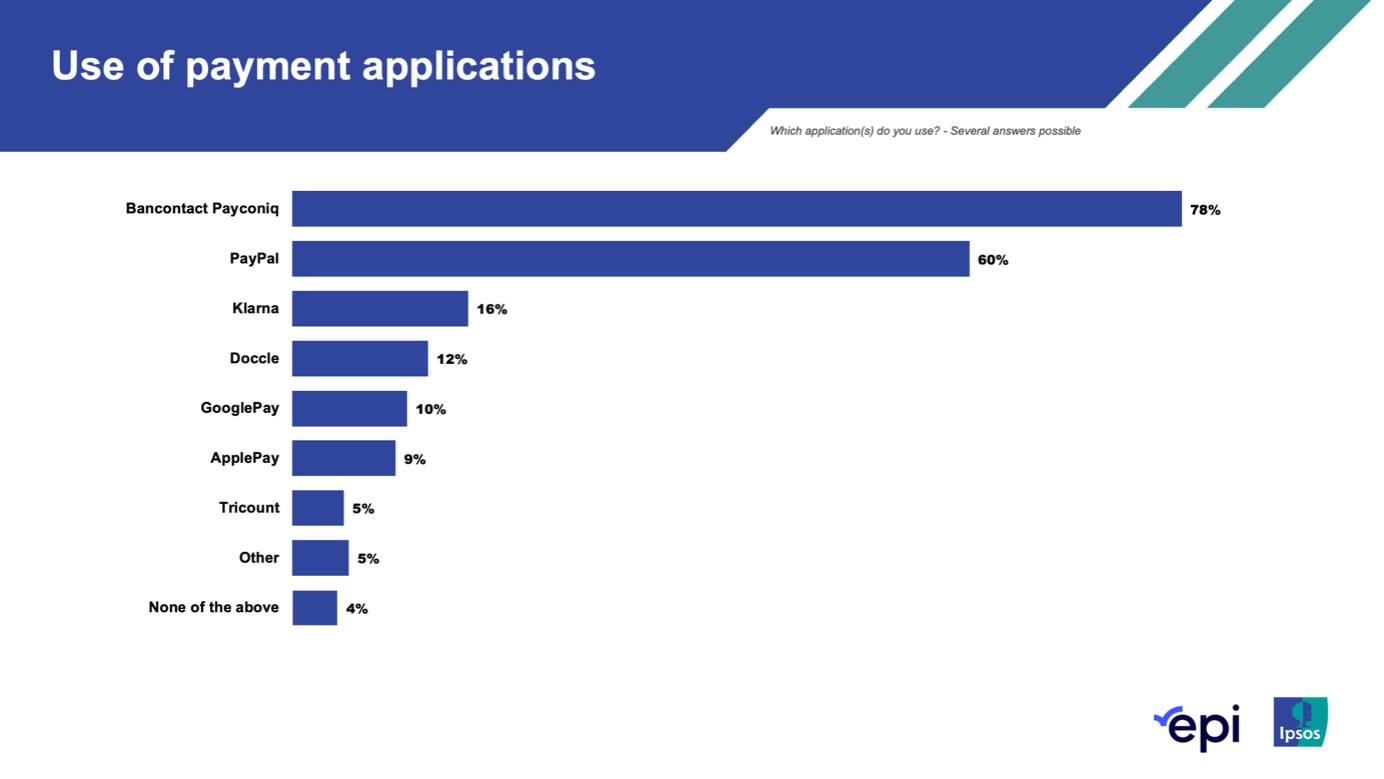

4. Payconiq, by far the most popular payment application in Belgium

Currently, Payconiq by Bancontact is the most popular payment app in Belgium, with 78% of users, followed by PayPal with 60%. Other applications include Klarna (16%), Doccle (12%), Google Pay (10%) and Apple Pay (9%).

Ralf Hamal (EPI) comments: “Together with the management of Bancontact Payconiq Company, we are reviewing the postioning of Wero to Payconiq. The Wero European payment wallet will deliver on its promise of speed and simplicity, and offer additional functionality.”

5. Will payment by QR code become the norm in the future?

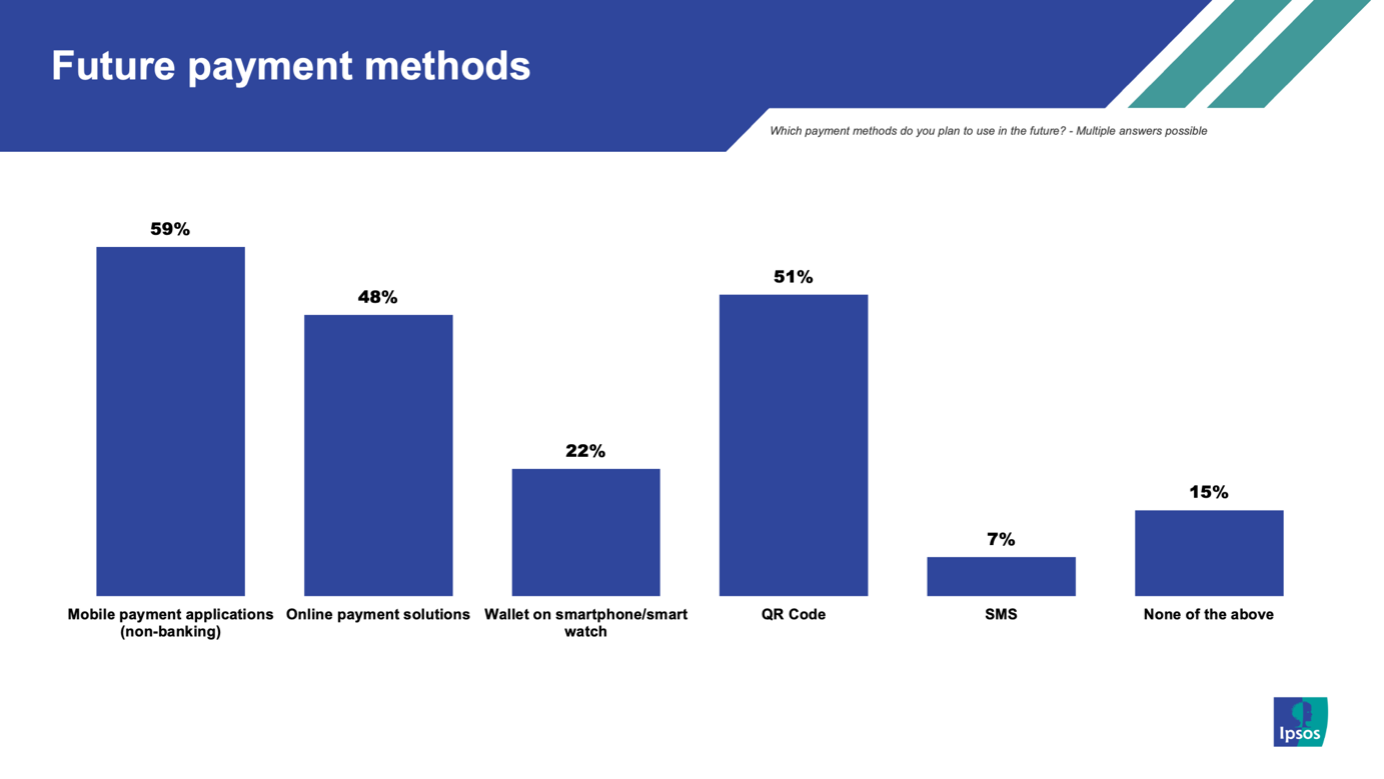

59% of Belgians surveyed say they plan to use non-bank payment apps in the future. 51% see a great future for QR code payments, and 48% say they will be making their payments online in the future.

Ralf Hamal (EPI) comments: “Consumer expectations are changing rapidly, and Wero has been designed to meet them. It will integrate QR code payments, merchant loyalty programs and instalment payments, to name but a few.”

About European Payments Initiative

EPI (European Payments Initiative) is supported by 16 European banks and payment service providers. They have joined forces with a common goal: to offer a unified digital payment service to all European businesses and citizens, wero. The EPI aims to enable European consumers and merchants to make next-generation payments for all types of retail transactions via a digital wallet. Based on instant account-to-account payments, wero will further streamline payments in Europe by eliminating intermediaries in the payment chain and the associated costs. Initially, wero will support P2P payments. This will be followed by P2Pro payments and payments for online and mobile purchases. Point-of-sale payments will also be included, as well as value-added services such as merchant loyalty program integration and instant financing.